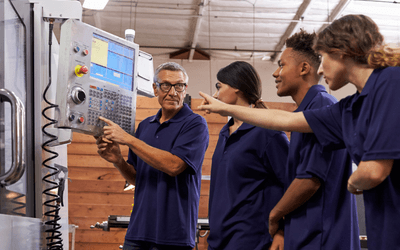

I regularly speak to Training & Engineering managers in leading MRO businesses and many of them are faced with the same challenges.

There is a chronic shortage of licensed engineers within the industry, which is resulting in more and more pressure on training departments to train up individuals to fill this void.

It makes sense. If you don't have them, train them. Yet in reality this training is expensive and takes staff away from the business and out of productive work in other roles.

That is where we need to look at this problem differently. There is apprenticeship funding available in the form of your apprenticeship levy, meaning you could make your costly aviation engineering training cost neutral. Now I know you want to know more.

The apprenticeship levy isn't just another tax for big businesses

When the apprenticeship levy was introduced in 2017 many corporate businesses saw it as an additional tax. It is true that all businesses with a wage bill over £3m need to pay 0.5% into the apprenticeship levy, but this isn't a tax, it's an investment piece.

You can draw down from this pot to fund training and development for your workforce and, if it runs out, you only pay 5% of the training costs, with the rest funded by the government.

If an employer has not paid the levy and would like to train an apprentice, they need to co-invest. For new starters from 1st April 2019, the employer has to pay 5% of the cost of training and assessment for their apprentices. Government funding of 95% is provided to cover the remaining costs.

I thought apprenticeships were for 16-18-year-olds?

It's a common misconception that apprenticeships are reserved for school leavers as an entry to the world of work. Yet apprenticeships are available to everyone in your workplace, regardless of age or ability. It doesn't just have to be for new employees either. You can enroll your current staff on an apprenticeship at any time.

Over a third of employees at Carbon60 are enrolled in an apprenticeship, from Level 2 Business Administration to Level 5 CMI Management, aged from 18 to our oldest learner in their late 50s, and all funded by the apprenticeship levy.

You have 24 months to use it, or you'll lose it

Once money is added to your levy pot, it has a life span of just two years, so this really is a use-it-or-lose-it scenario.

But this shouldn't discourage you from accessing it, as you are adding to the levy every month with your payroll. So as £1 expires it is likely another is being added and can continue to fund training.

I would encourage you to take the time to consider accessing your apprenticeship levy, so as not to lose out, and to ensure the funding is utilised to increase productivity and ultimately aid the growth of your business. Your estimated funds that are due to expire can also be viewed in your employer digital account.

Need more information on apprenticeship or how to unlock your levy? Book in a call with me to chat through your options.